Get on top of your debt and shave time off your loans

Dwindl your debt with each purchase you make.

Save Money, Pay Faster

Accelerate your debt payoff and achieve financial freedom sooner with automated roundups.

Feel Good, Debt Free

Experience the joy and peace of mind that comes with financial freedom.

Safe, Secure, Simple.

We use the same data centres trusted by some of Australia’s most highly-regulated organisations.

An average user could save up to $48,000 on a home loan with Dwindl*

Dwindl your debt with each purchase you make.

“I can't believe how great it is for helping me chip away at my debts!”

Certified User — Maddy T

How it Works

We take data protection seriously

Secure Environment

•

Multi-factor Authentication

•

Data Encryption

•

Restricted Network Access

•

Secure Development Practices

•

Realtime Monitoring

•

Secure Environment • Multi-factor Authentication • Data Encryption • Restricted Network Access • Secure Development Practices • Realtime Monitoring •

Secure Environment

•

Multi-factor Authentication

•

Data Encryption

•

Restricted Network Access

•

Secure Development Practices

•

Realtime Monitoring

•

Secure Environment • Multi-factor Authentication • Data Encryption • Restricted Network Access • Secure Development Practices • Realtime Monitoring •

What do you want to Dwindl?

-

Home Loan

Live in financial freedom sooner by paying off your home loan quicker

-

Car Loan

Hit the debt-free road sooner and get rid of that unwanted car loan.

-

Personal/Business Loan

Get rid of that cashflow drain and create new opportunities.

-

Savings Goals

Don’t have any debt? Then use Dwindl to chip away at your savings goals.

Frequently Asked Questions

-

To use Dwindl’s round-up feature, we securely track your everyday transactions in your bank account—but rest assured, it's all completely safe and authorised by you. You’re always in control.

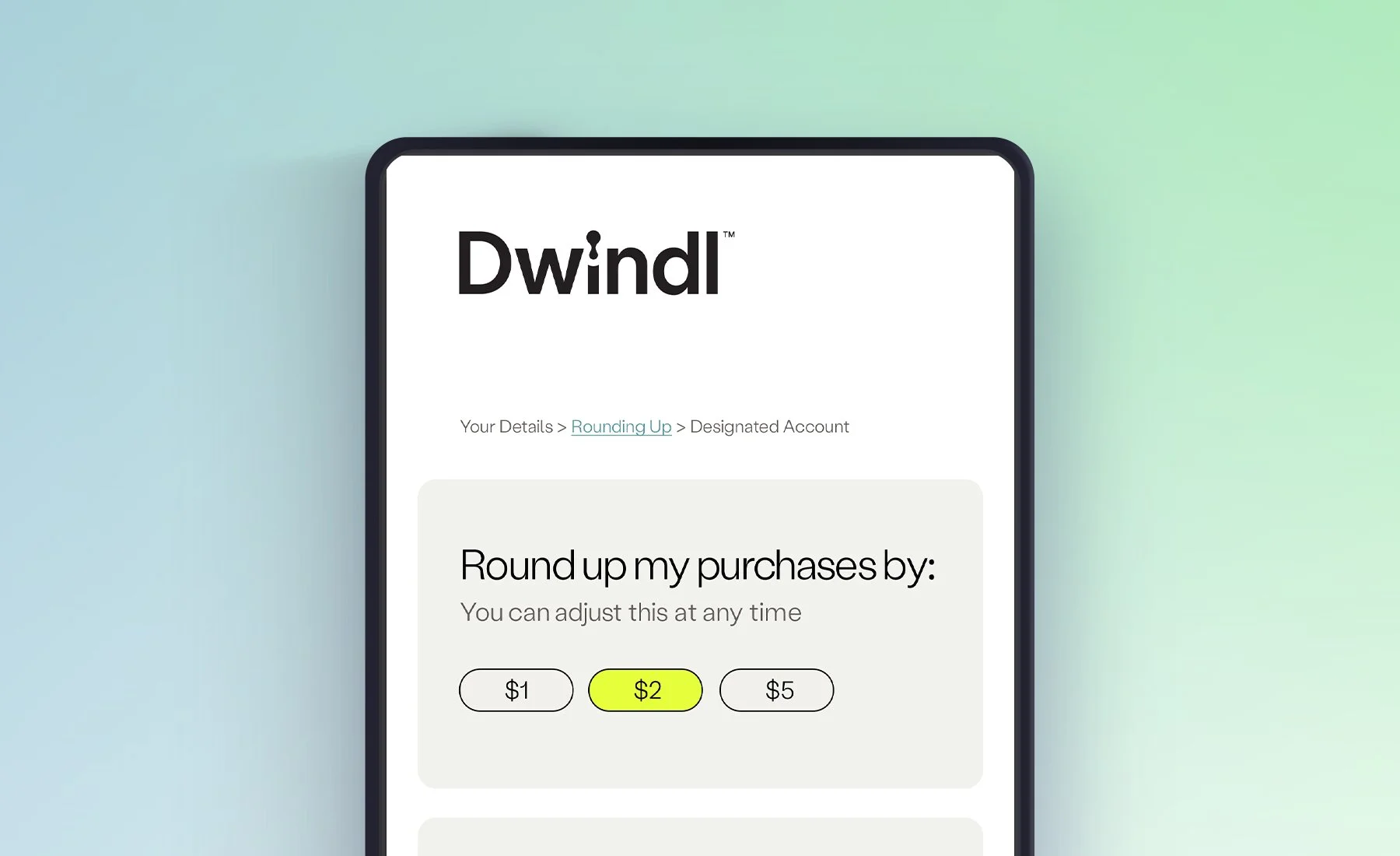

Once you give us permission, we’ll monitor your debit or credit card purchases and automatically round up each transaction to the nearest dollar or a custom increment of your choice. It’s like having a smart savings companion, helping you Dwindl debt with every purchase.

-

Dwindl calculates transactions on any connected bank account, including credit cards. However, you can only choose one funding account, which must be a savings or transactional account.

-

Your Round-Up accounts are the accounts where transactions are monitored to calculate Round-Ups.

A funding account is the savings or transaction account from which your Round-Up amounts are withdrawn. You can link multiple accounts and credit cards for Round-Ups, but the total Round-Up amount is debited from a single funding account.

-

When signing up for round-ups, you'll be prompted to connect your financial institution and permit Dwindl to access your transaction details. This authentication and connection process is securely managed by your bank.

-

When you first use Dwindl, your bank will ask for your CRN, the same one used for internet banking. If you're unsure of your internet banking CRN, you can find it by logging into your internet banking—it's usually listed in your account details.

-

Absolutely. Dwindl uses your bank's own internet banking portal, providing the same level of security as your bank. With "read-only" access, your account cannot be modified in any way. For more details, refer to Open Banking and the Consumer Data Right (CDR).

-

Yes, you have complete control! You can set your round-ups to the nearest $1, $2, or $5.

-

If there aren’t enough funds for a scheduled round-up debit, the transaction will fail and won’t be retried. Dwindl doesn’t charge dishonour fees, but your financial institution may.

-

You can put a pause on your round-ups, by toggling the feature on/off in settings. You can turn this back on at any time.

-

Your first month is free! After that, using Dwindl is a simple $4.25* per month for each user. Imagine finding financial freedom sooner for less than a price of a single coffee each month. It’s a no-brainer!

*Includes GST

-

You'll start seeing roundups accumulate immediately! Every roundup contributes to faster debt repayment, and you can track your progress within the app. Over time, you'll notice your savings on interest grow and a quicker path to becoming debt-free compared to just making the minimum required repayments.

Want to learn more?

Check out our resources for budgeting tips, debt hacks, product details and more

Let’s Start Dwindling

This three minute sign up could save you years of repayments

Already have an account? Sign In